Most Recent in ArcGIS Blog

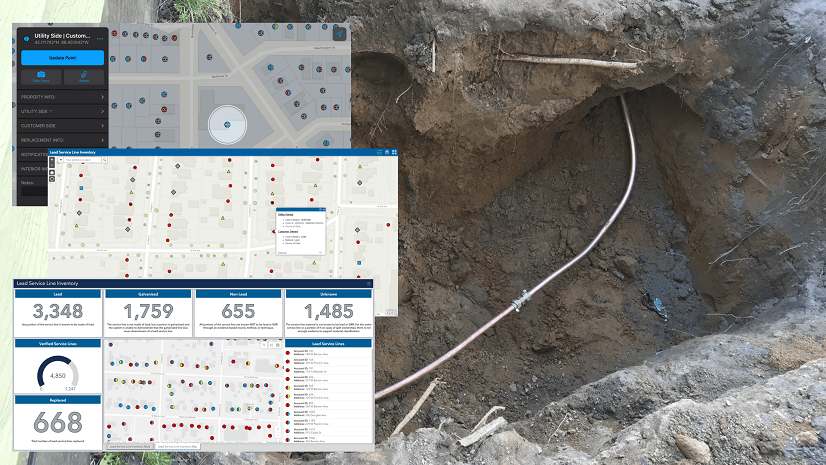

Preparing for Lead and Copper Rule Improvements

Water utilities with authoritative data, analytics, and technology solutions are going to successfully navigate improvements to the LCRR.

Identify the best location for an urgent care center

Multiple Authors | Analytics | April 2, 2024

Use suitability analysis in ArcGIS Business Analyst Web App to locate a site for a new urgent care center in Maverick County, Texas.

Most Recent in ArcGIS Blog

Christa Campbell | ArcGIS Field Maps | Apr 26, 2024

Water utilities with authoritative data, analytics, and technology solutions are going to successfully navigate improvements to the LCRR.

Multiple Authors | ArcGIS CityEngine | April 26, 2024

Introducing ArcGIS CityEngine Project Collaboration for designing urban Masterplans, coding procedural buildings, and digital production.

Multiple Authors | ArcGIS StoryMaps | April 25, 2024

Share your briefing slides with an interactive image gallery and more with the latest update to the ArcGIS StoryMaps Briefings app.

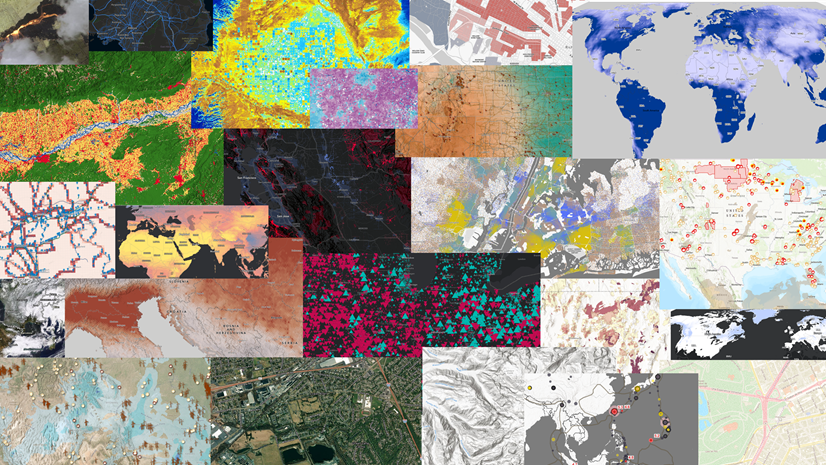

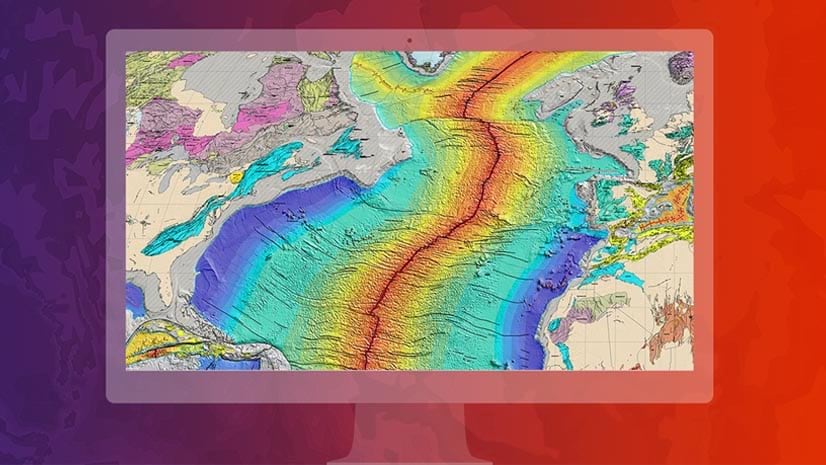

Multiple Authors | Developers | April 24, 2024

A Developer approach to imagery.

Shree Rajagopalan | ArcGIS Pro | April 24, 2024

Learn how to dynamically produce output data and information products at any scale from a single best-scale data source.

Lisa Berry | ArcGIS Living Atlas | April 23, 2024

Do you have questions about how to access, use, or nominate content within ArcGIS Living Atlas of the World? Check out this blog for answers.

Multiple Authors | ArcGIS Hub | April 23, 2024

Open data provides a foundation for collaboration and community engagement. It helps build trust and focuses discussions on fact.

Katie Thompson | ArcGIS Urban | April 23, 2024

ArcGIS Urban will soon be available with ArcGIS Enterprise, providing planners with a new way to leverage their city's GIS data for planning.

Multiple Authors | ArcGIS Mission | April 22, 2024

ArcGIS Mission 11.3 is coming soon. New features and enhancements bring analyst notes, new admin and user settings, and more!

Multiple Authors | ArcGIS StoryMaps | April 22, 2024

Get storytelling advice and conservation inspiration from the winners of the 2023 ArcGIS StoryMaps Competition.

Greg Lehner | ArcGIS Pro | April 22, 2024

If you receive a notification saying there's a drawing alert: don't panic! Let's solve it together.

Kerri Rasmussen | ArcGIS Field Maps | April 22, 2024

Start using Arcade in the Field Maps Designer.

Multiple Authors | ArcGIS Enterprise | April 22, 2024

Representing the user experience during Utility Network design, Mohan Punnam details the importance of keeping users at the forefront.

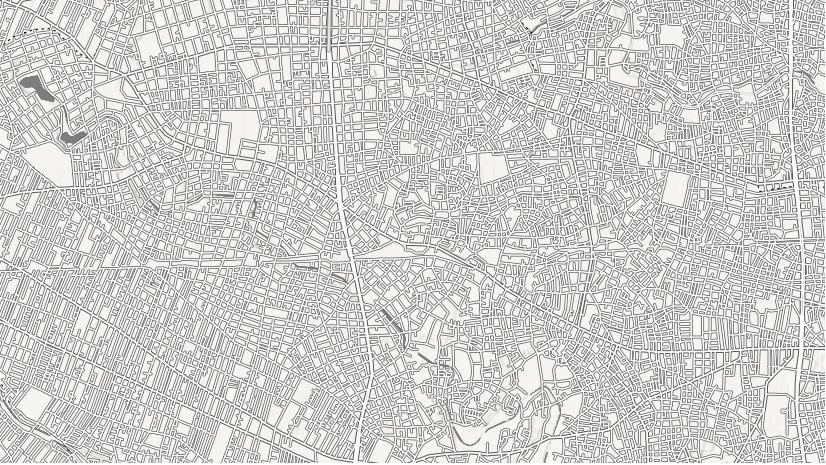

Multiple Authors | ArcGIS Living Atlas | April 19, 2024

Esri joins Overture Maps Foundation, supporting its mission to create reliable, easy-to-use, and interoperable map data for the globe.

Multiple Authors | ArcGIS Hub | April 18, 2024

Shawnlei Breeding shares her strategies for engaging volunteers and stakeholders to help protect eagles across The State of Florida.

Shane Matthews | ArcGIS Online | April 18, 2024

Esri's Basemaps continue to improve with over 300 new and updated communities, spanning 4 continents.

Multiple Authors | ArcGIS Hub | April 17, 2024

Hubs provide a virtual place for collaboration and engagement to happen within communities of all types and sizes.

Owen Evans | ArcGIS StoryMaps | April 17, 2024

Image gallery has made its way to briefings, and you can highlight a feature in a map by showing its pop-up.

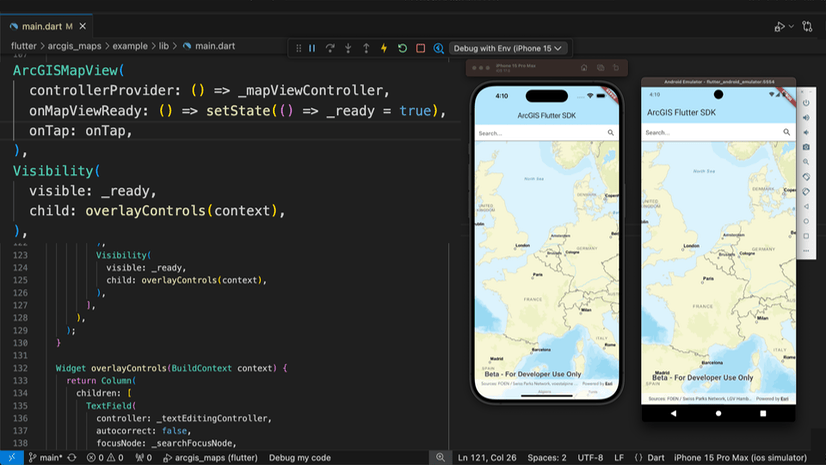

Multiple Authors | Developers | April 17, 2024

We are excited to announce the new ArcGIS Maps SDK for Flutter beta is now available!

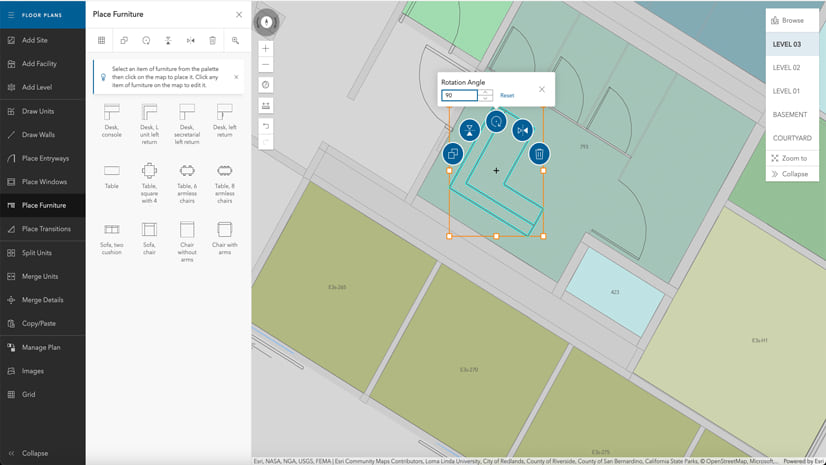

Multiple Authors | ArcGIS Indoors | April 17, 2024

Explore questions and answers from our webinar about Indoor GIS: Easy indoor map creation

Jeff Liedtke | ArcGIS Pro | April 16, 2024

Format your metadata for the video multiplexer tool to geoenable video data for the Full Motion Video player.

Multiple Authors | ArcGIS Enterprise | April 15, 2024

From emergency management to utilities, journey with Mark Sanders of Entergy, as he shares his passion for GIS.

Emily Garding | ArcGIS Online | April 12, 2024

Get more precision while editing in ArcGIS Online using interactive tooltips to set your own editing constraints.

John Nelson | ArcGIS Pro | April 12, 2024

How to configure scale-appropriate contour lines and their labels.

Bern Szukalski | ArcGIS Online | April 11, 2024

By default the ArcGIS World Geocoding Service is the locator used across your organization. Here's how to configure and use a locator view.

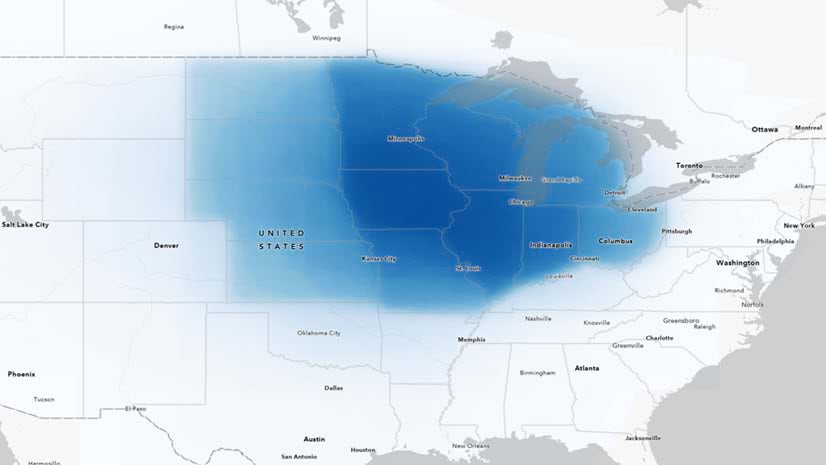

Multiple Authors | ArcGIS Survey123 | April 11, 2024

Answering regional geographers' favorite question: Where is the Midwest to you?