Most Recent in ArcGIS Blog

Esri joins Overture Maps Foundation

Esri joins Overture Maps Foundation, supporting its mission to create reliable, easy-to-use, and interoperable map data for the globe.

Identify the best location for an urgent care center

Multiple Authors | Analytics | April 2, 2024

Use suitability analysis in ArcGIS Business Analyst Web App to locate a site for a new urgent care center in Maverick County, Texas.

Most Recent in ArcGIS Blog

Multiple Authors | ArcGIS Living Atlas | Apr 19, 2024

Esri joins Overture Maps Foundation, supporting its mission to create reliable, easy-to-use, and interoperable map data for the globe.

Multiple Authors | ArcGIS Hub | April 18, 2024

Shawnlei Breeding shares her strategies for engaging volunteers and stakeholders to help protect eagles across The State of Florida.

Shane Matthews | ArcGIS Online | April 18, 2024

Esri's Basemaps continue to improve with over 300 new and updated communities, spanning 4 continents.

Multiple Authors | ArcGIS Hub | April 17, 2024

Hubs provide a virtual place for collaboration and engagement to happen within communities of all types and sizes.

Owen Evans | ArcGIS StoryMaps | April 17, 2024

Image gallery has made its way to briefings, and you can highlight a feature in a map by showing its pop-up.

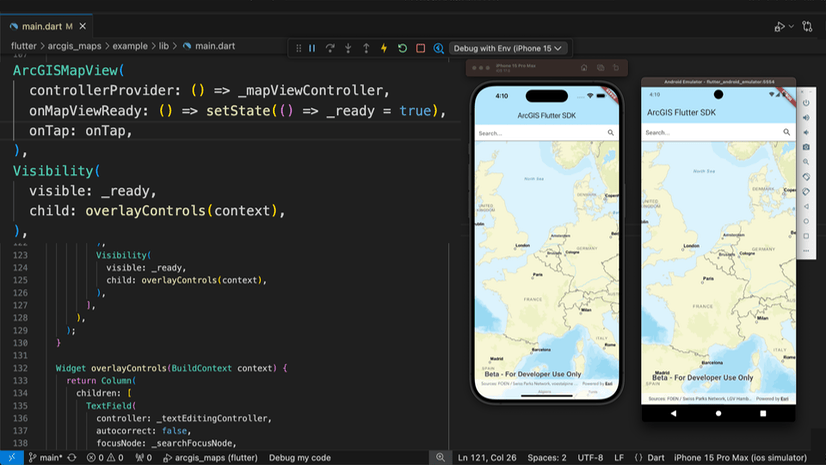

Multiple Authors | Developers | April 17, 2024

We are excited to announce the new ArcGIS Maps SDK for Flutter beta is now available!

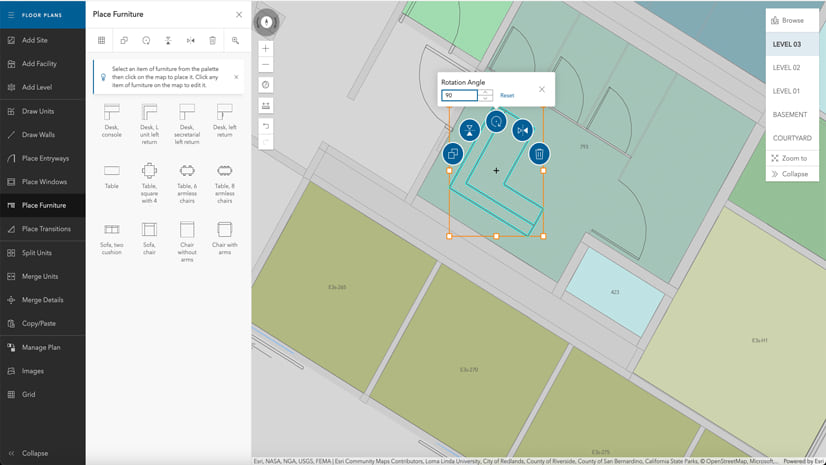

Multiple Authors | ArcGIS Indoors | April 17, 2024

Explore questions and answers from our webinar about Indoor GIS: Easy indoor map creation

Jeff Liedtke | ArcGIS Pro | April 16, 2024

Format your metadata for the video multiplexer tool to geoenable video data for the Full Motion Video player.

Multiple Authors | ArcGIS Enterprise | April 15, 2024

From emergency management to utilities, journey with Mark Sanders of Entergy, as he shares his passion for GIS.

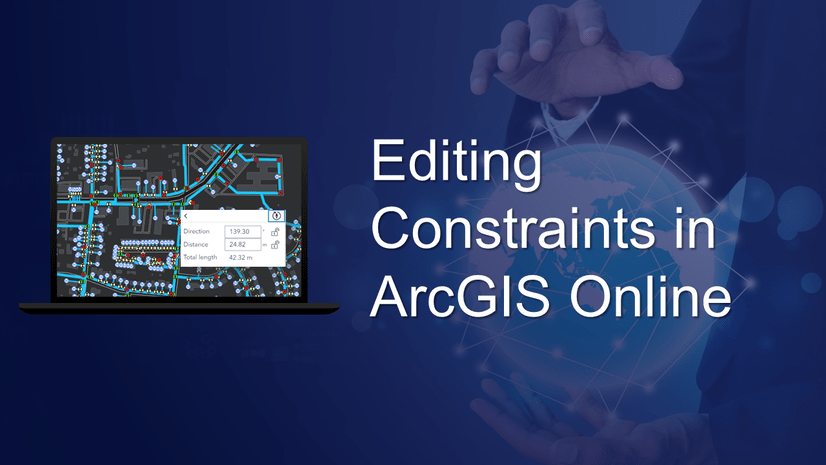

Emily Garding | ArcGIS Online | April 12, 2024

Get more precision while editing in ArcGIS Online using interactive tooltips to set your own editing constraints.

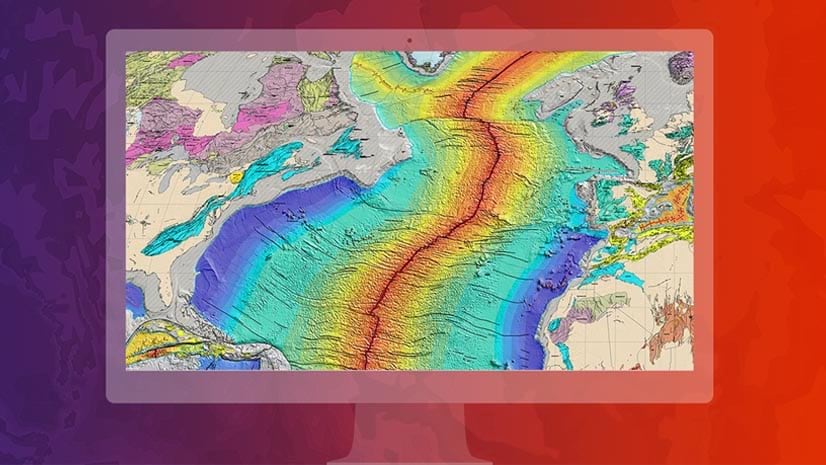

John Nelson | ArcGIS Pro | April 12, 2024

How to configure scale-appropriate contour lines and their labels.

Bern Szukalski | ArcGIS Online | April 11, 2024

By default the ArcGIS World Geocoding Service is the locator used across your organization. Here's how to configure and use a locator view.

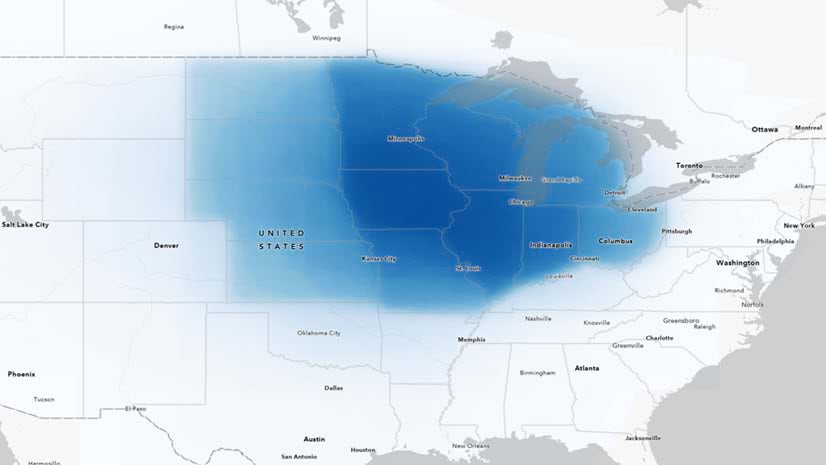

Multiple Authors | ArcGIS Survey123 | April 11, 2024

Answering regional geographers' favorite question: Where is the Midwest to you?

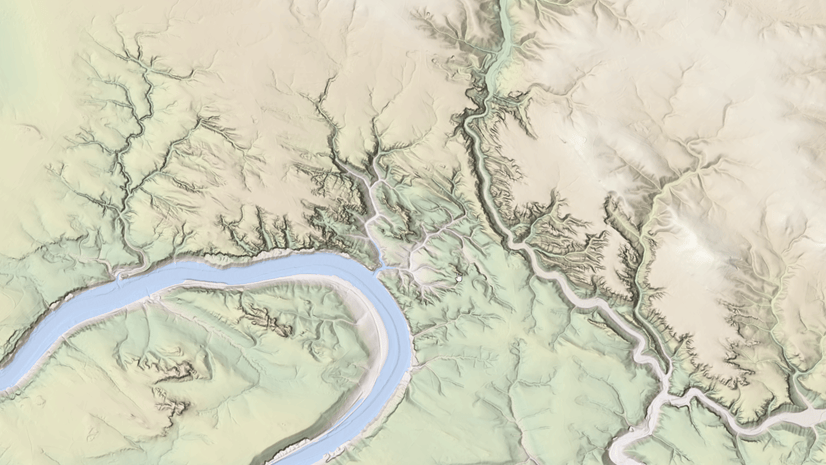

Rajinder Nagi | ArcGIS Living Atlas | April 11, 2024

In April 2024, elevation layers have been updated with high-res datasets of Wales, New Zealand & German states of Bavaria, Saxony and Brandenburg

Multiple Authors | Developers | April 11, 2024

Version 200.4 of the ArcGIS Maps SDKs for Native Apps includes support for feature forms, snapping, OGC 3D Tiles, and more!

Multiple Authors | ArcGIS Maps SDK for Unreal Engine | April 11, 2024

ArcGIS Maps SDK 1.5 for Unreal Engine adds support for Esri's global OSM 3D Buildings layer, group layers, and more!

Multiple Authors | ArcGIS Maps SDK for Unity | April 11, 2024

ArcGIS Maps SDK 1.5 for Unity adds support for Esri's global OSM 3D Buildings layer, group layers, and more!

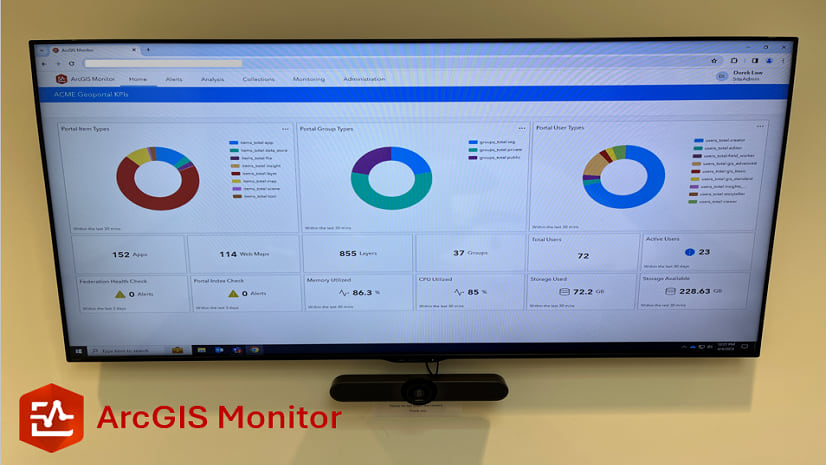

Multiple Authors | ArcGIS Monitor | April 10, 2024

This blog presents six useful indicators that provide insight on Enterprise portal performance metrics.

Multiple Authors | ArcGIS Pro | April 10, 2024

With ArcGIS Pro 3.2 or later, you can export all symbols in your project to a custom style.

Raluca Nicola | ArcGIS Maps SDK for JavaScript | April 10, 2024

A small hack for adding a watercolor basemap to a 3D city visualization

Mindy Longoni | ArcGIS Solutions | April 10, 2024

Maintain a road-closure inventory and share important road information with the public with the Road Closures solution.

Stephanie Umeh | ArcGIS Experience Builder | April 9, 2024

This blog article showcases an inventory of GIS-related web applications and maps built in 2023 using ArcGIS Experience Builder.

Silvia Pichler | ArcGIS IPS | April 9, 2024

Read this customer success story of how ETH Zurich creates a smart campus using indoor GIS on their university premises.

Greg Lehner | ArcGIS Pro | April 8, 2024

In ArcGIS Pro 3.2, you can copy and paste the layer properties of one layer to another layer.

Bern Szukalski | ArcGIS Online | April 8, 2024

Search in maps and apps uses locators configured for your organization, or layers and fields in maps. Here's how to configure them.

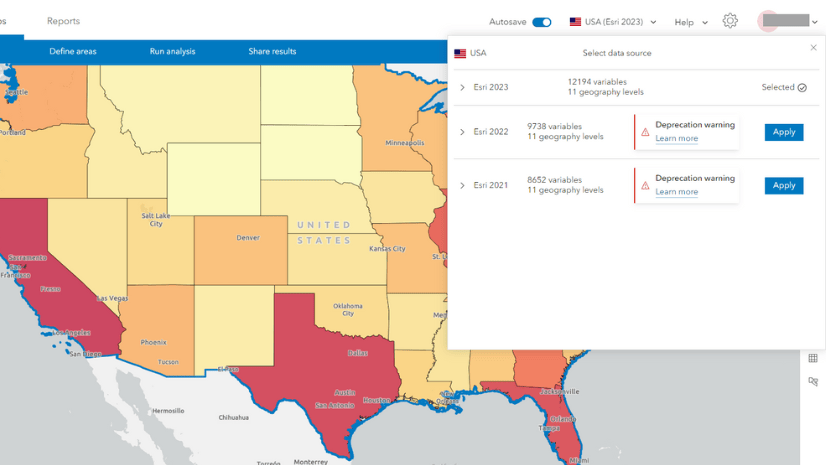

Multiple Authors | ArcGIS Business Analyst | April 8, 2024

In the June 2024 release, the Esri 2021 and Esri 2022 data sources will be deprecated in ArcGIS Business Analyst Web App.